Protect your family and legacy with

Affordable, Personalized Estate Planning

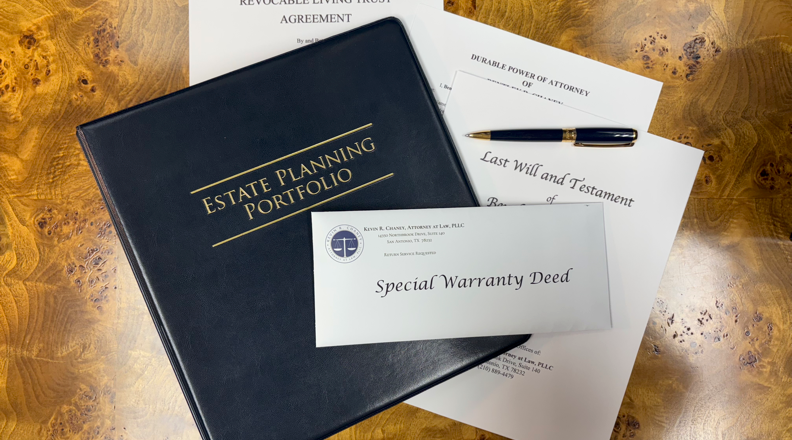

Wills & Trusts • Trustee Services

Revocable Transfer on Death Deeds•Ladybird Deeds•Powers of Attorney•Living Wills

Misconceptions

about Estate Planning . . .

"An ounce of prevention..."

"...is worth a pound of cure." That adage was never truer than when applied to estate planning. Probate is an expensive, stressful "cure" for circumstances that are easily preventable. A few preventative measures can ensure that your wishes are honored and your loved ones are protected in the event of incapacity or death.

Dealing with the loss of a loved one is painful enough. Having to cope with loss while managing the estate of one who died without a will leaves grieving loved ones with unnecessary expense and hardship. Just a little planning can save your family from added cost, stress, and grief.

A few simple steps can yield numerous benefits, such as . . .

-

protect your beneficiaries

-

ensure your children are cared for according to your wishes

-

ensure your property goes where you want it to go

-

save the estate -- and, thus, your beneficiaries -- money ... a lot of money

-

save your beneficiaries time and stress

-

protect family relationships by reducing the chance of conflict and lawsuits

-

avoid guardianship proceedings

-

avoid or minimize costly, lengthy probate

. . . to name a few.

-

Estate Planning is expensive. Not true. Probate is expensive! The cost of estate planning is far less than the cost of probating an "unplanned" estate.

-

Estate Planning is for Seniors. Again, not true. Every adult -- and their beneficiaries -- benefits from basic estate planning. And if you have a family, you owe them the peace of mind and security of proper planning in the event of your incapacity or untimely death.

-

Estate Planning is for the wealthy. Wrong. Estate planning is for any adult with assets they want to keep out of probate.

-

Estate Planning is complicated. In most cases, it's not. It can be more complicated for high net worth individuals, but estate planning is very straightforward for most people.

-

I don't need an attorney, I can just download a will online. You can, but there's a strong possibility that downloaded will isn't valid in Texas.

-

I already have a will, I don't need a trust. That's might not be true. A trust functions differently than a will. A will ensures that the probate court will cause your property to pass according to your wishes. A trust can keep that property out of probate altogether, saving time and a lot of money. And a revocable trust allows you complete control over the property in the trust as long as you're alive.

Professional Trustee Services

Why choose our firm as trustee for an irrevocable trust?

1) Professional, dependable administration

Serving as trustee is a serious fiduciary role. We bring a structured, repeatable process for distributions, record keeping, and reporting—so the trust is administered consistently and on time.

2) Reduced family conflict and pressure

Many families appoint a professional trustee to avoid putting a relative in the middle. An independent trustee can enforce the trust terms fairly and help reduce misunderstandings and disputes.

3) Clear documentation and defensible decision-making

Trustees are often judged by the paper trail. We document distributions and discretionary decisions, maintain organized records, and provide regular updates so beneficiaries understand what is happening and why.

4) Strong compliance and risk management

We help the trust stay compliant with fiduciary standards and administrative requirements, including coordination with CPAs and financial institutions and timely handling of notices, accountings, and tax documents.

5) Practical business judgment

When trusts intersect with business or real estate issues, clients value a trustee who understands operations, contracts, and risk—not just the legal theory. We bring that practical perspective to trustee decisions.

6) Transparent fees and clear separation of roles

We use a written trustee compensation and billing policy and separate trustee services from any legal work, so there is clarity on what is included, what is billed, and who pays.

7) Efficient coordination with banks and professionals

We routinely work with trust departments, custodians, CPAs, and advisors, which helps keep administration smooth—especially during trustee transitions and distribution processing.

8) Stability and continuity

A professional trustee can provide continuity over time, even as family circumstances change. That consistency is often one of the main reasons clients choose a firm to serve in the role.

Trustee services are separate from legal services; if legal representation is needed, it is addressed through a separate engagement agreement.

Questions about Wills, Trusts or Estate Planning?

We take the confusion out of Estate Planning

Call, email, or simply click the button below to schedule a free 30-minute consultation. We'll listen to your goals and concerns, and offer clear, guidance -- no jargon. We'll explain how a few simple steps can protect your family and your property.